In 2009, the Tax-Free Savings Account (TFSA) was introduced by the Canadian federal government. The TFSA is a great option to help Canadians save for long and short term financial goals and the funds can be withdrawn at any time on a tax-free basis.

In 2009, the Tax-Free Savings Account (TFSA) was introduced by the Canadian federal government. The TFSA is a great option to help Canadians save for long and short term financial goals and the funds can be withdrawn at any time on a tax-free basis.

Unlike a Registered Retirement Savings Plan (RRSP), the TFSA is meant to help you save for any type of general savings needs as opposed to simply retirement. There is no penalty to withdrawing funds from your TFSA whereas withdrawing funds from an RRSP will have resulting tax implications. However, like an RRSP, there is an annual contribution limit. For a TFSA the annual contribution limit is not linked to your income, but rather it is set by the federal government and it is the same limit for all Canadians.

How the TFSA Works

Here is some general information on how the TFSA works:

- Canadian residents age 18 and over can save up to $10,000 (beginning in 2015) a year in a TFSA

- Contributions are not tax-deductible, but investment returns (capital gains, interest and dividends) earned in a TFSA are not taxed, even when withdrawn.

- Withdrawals are tax-free and funds can be used for any purpose.

- Unused contribution room can be carried forward indefinitely. As well, any amount withdrawn from a TFSA can be re-contributed in a future year without requiring new contribution room.

- Neither income earned in a TFSA nor withdrawals will affect eligibility for federal tax credits or income-tested benefits such as the Canada Child Tax Benefit, Old Age Security (OAS) or the Guaranteed Income Supplement (GIS)

- Investments eligible for an RRSP can generally be held in a TFSA.*

Annual Contribution Limits

If you have never contributed to a TFSA before, the contribution limits from 2009 are cumulative. Thus, if you were to open a TFSA today you could contribute a maximum of $41,000.00, and then an additional $10,000.00 per year going forward.

| Year | Contribution Limit |

| 2009 | $5,000.00 |

| 2010 | $5,000.00 |

| 2011 | $5,000.00 |

| 2012 | $5,000.00 |

| 2013 | $5,500.00 |

| 2014 | $5,500.00 |

| 2015 | $10,000.00 |

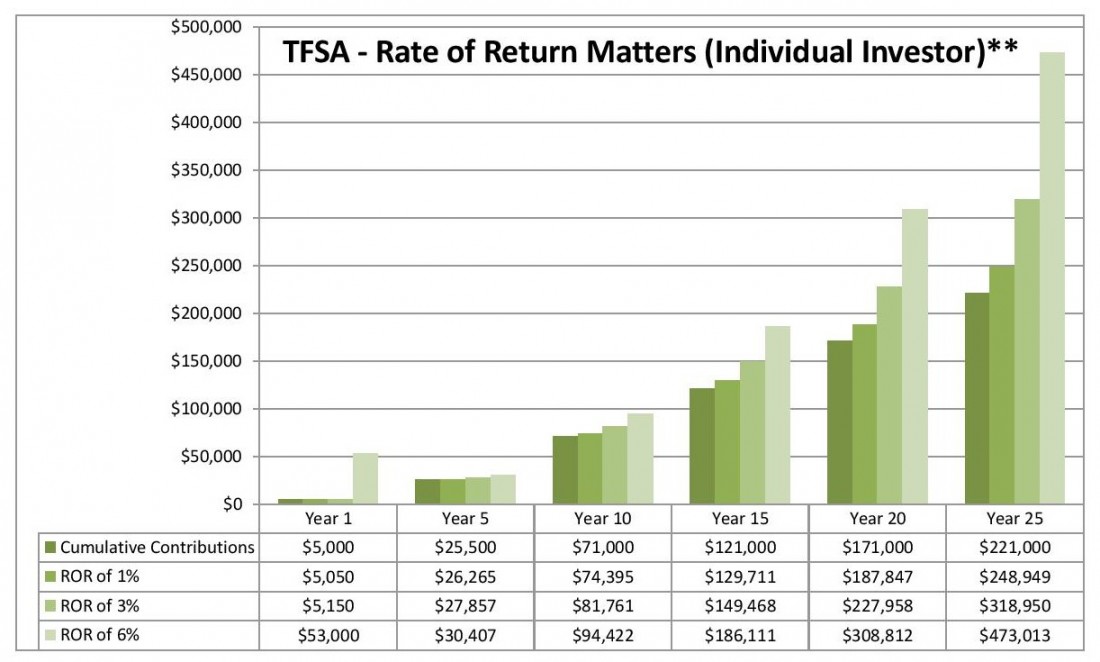

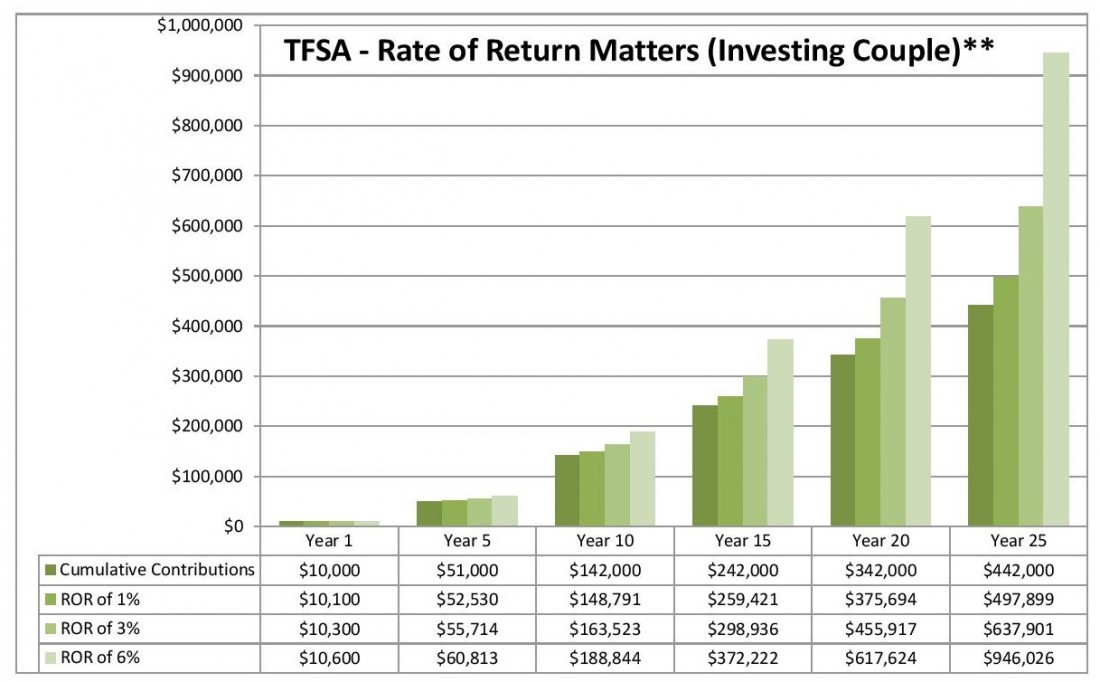

Rate of Return Matters

Since the funds held within a TFSA are mutual funds, the better your rate of return, the faster your savings will grow. Please refer to the below charts developed by RBC Global Asset Management for some examples as to how much your TFSA may be worth assuming the contributions are maxed out.

Who does the TFSA benefit?

As you can see from above, the TFSA is a great option (whether you are an individual investor or an investing couple), even if you cannot invest the maximum allowable contribution on a yearly basis.

Thus, the TFSA can benefit the following:

- Young people just starting out: TFSAs will stimulate more savings when starting at a younger age.

- Seniors: TFSAs can provide retired persons with a means to save on a tax-free basis; neither withdrawals nor income earned in a TFSA will trigger clawbacks on Old Age Security (OAS) benefits or the Guaranteed Income Supplement (GIS).

- High Income Earners: Taxpayers who have already made the maximum contribution to their RRSPs will have another tax sheltered savings vehicle.

- Lower Income Earners: Taxpayers in a lower tax bracket may prefer to forgo the modest tax deduction of an RRSP in exchange for tax-free growth and withdrawals of a TFSA.

- Anyone Saving for a Large Ticket Item: TFSAs can be used to fund a car purchase, vacation or down payment on a house.*

In other words, the TFSA can benefits just about EVERYONE!

If you would like more information on TFSAs or would like to open a TFSA, please contact us.

Footnotes:

*Excerpt from Mackenzie Investments Flyer. “Introduction to TFSAs.”

**Chart complied from RBC Global Asset Management Charts: Tax Free Savings Accounts – Rate of Return Matters (Individual Investor) & Tax Free Savings Accounts – Rate of Return Matters (Investing Couple).